No person can predict tomorrow, and that means you cannot understand what can come in order to interest rates for the one, a few otherwise five years. However,, it can be wise if for example the circumstances imply you would prefer to know your instalments for five years, therefore must secure an increase.

Wish to know more info on lso are-repairing or repairing a varying rates?

Westpac people can be below are a few its fixed expiry possibilities otherwise get help by the calling 8am-8pm, Mon-Fri and you may 9am-6pm, Sat-Sun (Quarterly report date): 132 558 or, reservation a callback.

cuatro. What goes on in the event the interest levels drop within my repaired speed term?

If rates of interest get rid of (otherwise rise, even) through your repaired rate period, it will not apply at your payments once the you’ve secured of your property loan rate to possess an arranged identity, to 5 years. Locking in your rate has its masters, particularly when pricing increase, and also it means you will know with the repaired months precisely exactly what your minmum costs might be. The actual only real negative was, however, in the event the rates of interest decrease. If this happens following you’ve fixed your loan, you’ll need to experience it, as the cracking your fixed speed several months could cost your alot more from inside the crack charge** compared to the positives you’d acquire from a reduced rates.

Ought i crack my fixed rate identity so you can lock in an effective new speed?

It is really not a smart idea to crack a fixed rate period more often than not. The reason is crack costs** get incorporate, and they can be quite costly, especially if you continue to have more than 1 / 2 of your own fixed title going. However,, assume you really have per year or less until the repaired name ends, and you need to split the label to shut the loan, make modifications into the financing, proceed to a variable rate or lock in another type of repaired term to protect oneself out of you’ll rates goes up. You’d maybe turn to split a predetermined months in the every one of these scenarios, though you have to be mindful because crack will set you back will likely be pricey. Before deciding, you will want to consult some slack cost offer to determine if it’s really worth using crack charges.

Westpac people can demand a quote of the contacting 8am-8pm, Mon-Fri and you will 9am-6pm, Sat-Sunshine (Questionnaire time): 132 558, or scheduling a good callback.

What exactly are split costs while do it pertain?

If one makes a change to your house loan for the repaired title. Includes: switching to a special the best payday loan Iowa lender otherwise unit, modifying interest rate, or altering your payment style of.

What is the prepayment endurance?

Simple fact is that amount your lender has actually given that you could build from inside the a lot more repayments in the financial account more than a predetermined rates months versus taking on split will set you back**. At the Westpac, brand new prepayment endurance getting a fixed speed home loan try $31,000 during the repaired title.

5. How can i lso are-develop my personal home loan?

All financial will have a technique for you to pursue. More often than not, they’ll give you good pre-expiry page letting you know that your particular repayments are switching, and the ways to re also-improve prior to your existing repaired rate term concludes.

When can i examine my price selection?

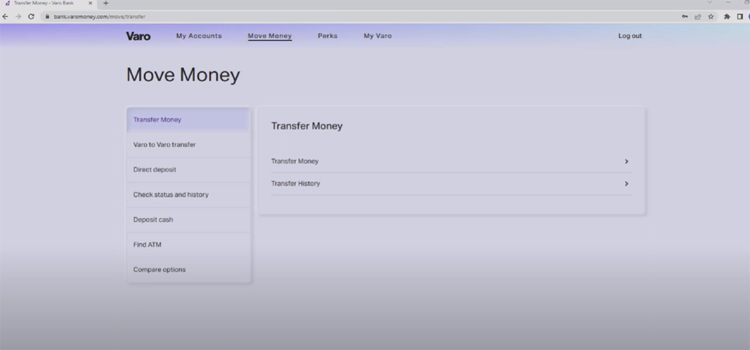

If you find yourself with Westpac you can observe the repaired expiry attract price options on Westpac Application and online Financial, doing six-2 months before expiry. And you may here’s how to re-boost around:

- Pick your house mortgage. Pick Security passwords, then Have a look at alternatives hook. Prefer your brand new repaired label as much as 5 years. In order to hold the exhibited speed, get the Fixed Speed Secure-for the choice step 1 (if not we’re going to incorporate the interest rate a couple of business days until the prevent of your fixed identity). Hit show.

Scrivi un commento