An excellent USDA mortgage are a government-supported, no-money-off financial specifically made to own buyers and you can property from inside the quicker-heavy parts of the country, in addition to rural and you will suburban areas inside Fl.

If you’re considering to invest in a house outside of towns, the new USDA’s financial system could possibly offer you several advantages, as well as all the way down interest levels and payments versus most other authorities-recognized programs eg FHA and you will Virtual assistant.

Inside Fl, the fresh new USDA stands for the united states Company from Farming, an agency known for the engagement in farming, forestry, and you can eating-associated initiatives.

To decide if the a home is eligible to possess a USDA mortgage, you can reference new USDA Qualifications Map. Believe it or not, 91 per cent of one’s United states, and additionally various parts of Fl, falls when you look at the USDA boundary.

This means that when you find yourself a first-date house buyer looking to purchase a property outside of metropolitan section within the Fl, by using the USDA’s financial program might be a feasible choice.

Why does good USDA Mortgage Work?

USDA funds into the Fl is type of since they’re secured by new You.S. Service away from Agriculture, decreasing the chance getting lenders and allowing them to provide all the way down rates. This type of finance haven’t any prepayment punishment, enabling consumers to settle its funds early as opposed to a lot more costs.

Due to the USDA be certain that, these types of finance usually have interest rates as much as 0.50 percentage factors lower than most other lower-down-payment options such as for example HomeReady, HomePossible, and you can Traditional 97, also less than Va mortgage loans, taking high benefit for homeowners.

How does This new USDA Identify Rural?

The term “rural” to have USDA fund in the Florida is derived from Part 520 out-of the latest Houses Act away from 1949.

Teams maybe not meeting this type of outlying standards are known as “metropolitan.” It is essential to observe that no particular government definition can be obtained to possess suburbs otherwise exurbs. Thus, all of the You residential property fall under rural or urban.

When you look at the 2020, the Census Bureau produced even more requirements to acknowledge between rural and you can cities at level loans in Springville of census tracts. An outlying census system is understood to be meeting next standards:

- This is not inside an one half-mile distance away from a keen airport that have an annual passenger number off 2,five hundred or maybe more.

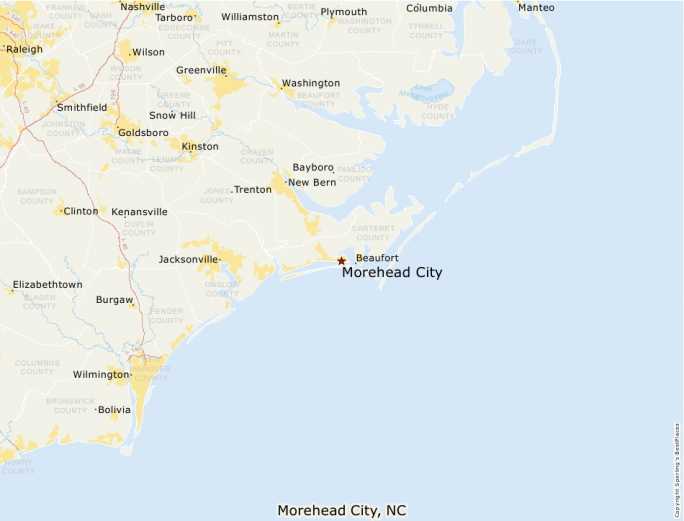

USDA Qualifications Chart

You need that it USDA qualifications chart to locate a speech and see if or not property currently match the latest USDA’s possessions qualification conditions.

By using the USDA map, you could rapidly determine whether a property we would like to buy could well be eligible for the applying. Other areas qualified to receive characteristics changes yearly consequently they are calculated from the inhabitants density and other situations.

An effective USDA-recognized lender like MakeFloridaYourHome is also be certain that this new qualification of all of the properties you desire. To save lots of your time to the functions which could not be eligible, it’s always best to contact good USDA-accepted bank to confirm your own address to have good USDA mortgage.

How can you Be eligible for an effective USDA Mortgage?

Potential home purchasers need to meet certain criteria of property location and money so you can qualify for a great USDA mortgage for the Florida. Additionally, they need to satisfy most other important financial official certification.

Assets Place

The house bought have to be when you look at the a rural census region laid out of the USDA. New property’s qualification is confirmed utilizing the USDA site otherwise consulting your mortgage lender.

Income Qualifications

Homebuyers need a family group earnings within the USDA’s given lower to help you reasonable money limits for their urban area. These restrictions appear towards the USDA site otherwise would be obtained as a consequence of a discussion which have MakeFloridaYourHome.

Credit history

Applicants are needed to demonstrate a typical reputation of with the-date expenses money, indicating their capability to manage monetary duties effectively.

Scrivi un commento