Improve assets do the job Sweat your own resource that have a vacation hustle because of the leasing your guest area(s) throughout height travelling and you will travel seasons (if you can). If the property enjoys twin life prospective, envision maximising can leasing you to definitely area aside since the short or long-term accommodation. In any event, this extra earnings put in the bond could be a-game-changer.

To date, you really have an option: hold the financing account unlock or romantic it

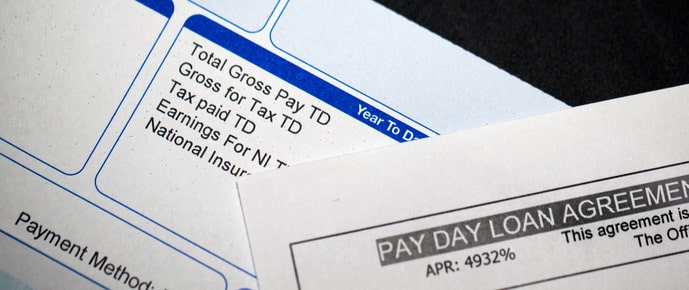

Combination route If you’re juggling several money, like your car finance along with other huge-pass points, browse the the efficacy of combination. Of the consolidating the debt into an individual financing, you could feasibly negotiate lower rates of interest and explain their installment excursion. However, discover positives and negatives to that choice, so make sure you speak to a professional financial specialist before choosing to wade this channel.

Tailored home loan cost procedures

Regardless of where you’re on your home resource trip, settling your home mortgage quicker is a proper circulate you to definitely can alter debt mindset. Let’s talk about a few of the options for different varieties of assets people, that may assist you to influence the effectiveness of early bond settlement:

First-day homebuyers While the a first-go out buyer, as opposed to expenses rent, it is best to enter into the house industry as soon as you possibly can instead of slowing down the acquisition unless you can also be manage their forever family. Buy an inexpensive entryway-height domestic that delight in in the really worth throughout the years and that you are sure that you really can afford to pay off less. In that way, new security which you build adding toward repayments early on the financing term may then serve as a stepping stone so you’re able to updating to the dream domestic.

Emerging traders Local rental money often merely facilitate investors break even (when see the site they fortunate) on monthly payments towards possessions, very paying off the house financing reduced will mean higher winnings using your local rental income. For those starting out, it is better to choose an easily affordable possessions in which the local rental earnings provides the possibility to safeguards extremely (if not all) of your own monthly expenditures of the house therefore, the individual can also be run to make a lot more money on loan. Quicker the borrowed funds is reduced, the latest quicker the newest individual can take advantage of natural money toward assets.

Experienced traders Just in case you individual numerous investment attributes, a comparable reasoning applies. The sooner your debt try paid down, the earlier brand new investor can be discover a passive earnings through renting out of the household. If your tip is always to sell the property to move so you can large capital choice, the more guarantee that is produced in the house, the greater the fresh new individual will be able to manage in their second get discover deluxe services otherwise explore solution home options.

If you do attained your aim out-of paying off your house mortgage ahead, ensure that you’ve take a look at the conditions and terms on your package. There might be charges if you settle your property loan as well early. Both, regardless of if, you might avoid this when there is an alerts several months and you promote notice in a timely fashion or if you take-out a different sort of thread with the exact same bondholder. There is also likely to be bond cancellation charge that you will need to safety.

That benefit of looking after your thread account unlock is that you can be control the fresh new collateral at your residence for other financing. At the same time, due to the fact interest rate towards the house is constantly below with other financing, your own bond membership are a less costly source of borrowing. It is essential to cautiously review the new regards to the loan agreement making an educated choice on how your take control of your home mortgage and you will financial situations.

Scrivi un commento