- Share for the LinkedIn

- Share of the Current email address

Family guarantee is the difference between a great house’s really worth in addition to a great financial harmony on assets. Such as, a home cherished during the $1,one hundred thousand,one hundred thousand which have good $five-hundred,100 financial harmony a great with it features $500,one hundred thousand away from offered collateral.

Your home guarantee increase since you reduce the harmony of their a great mortgage, or help the value of your residence, possibly using renovations or love into the assets opinions.

Whenever would it be for you personally to thought leverage your residence guarantee having almost every other objectives? You to definitely is based entirely on your own personal things, but domestic equity is oftentimes your own ideal economic asset and that is worth considering when planning tall methods.

House Home improvements

Probably one of the most popular strategies for domestic security was to have house renovations. Regardless if you are merely repainting your house, surroundings your garden, updating products, hurricane proofing, and work out necessary solutions, or giving a kitchen otherwise bathroom a whole transformation – renovations raise each other your thrills in your home if you are inside, and you may donate to enhancing the property value the house. It could build plenty of sense to use part of the modern worth of your home to boost its coming worth.

Whenever believed home improvements, envision the way they you will join the worth of your house. Plans thought planning to supply the finest return on investment to have people is:

- Improvements to make sure your home is hurricane and you can piece of cake-evidence

- Painting: freshens up your space

- Land and additional home improvements: adds to curb desire

- Lawn patio otherwise platform: expands living space

- Home or restroom repair: standing your property and you will helps it be more inviting

To purchase another type of property

Its not usually had a need to sell our home you may have in the buy buying various other property. Either, you can make use of your current family collateral to cover the latest off-percentage into a home loan having one minute household, or perhaps to let a relative safer its first-mortgage.

Studies

Home equity could also be used to cover informative expenses. Learning abroad, particularly, might be costly; college students just who manage to get thier college or university studies inside the a foreign nation is normally expect you’ll scholar having significantly highest debt than the average student in their home nation. House guarantee enables you to finance your child’s traditions and you may university fees expenses if you’re abroad, reducing the personal debt they usually have to manage just after graduation.

Unforeseen Incidents

Naturally, both life leaves up erratic events that need immediate action. Unforeseen expenditures is a major supply of financial anxiety. Property collateral loan makes it possible to settle unforeseen expenditures easily, probably cutting focus repayments to your the individuals costs and you will any damage to your credit score.

Making an application for a home security financing

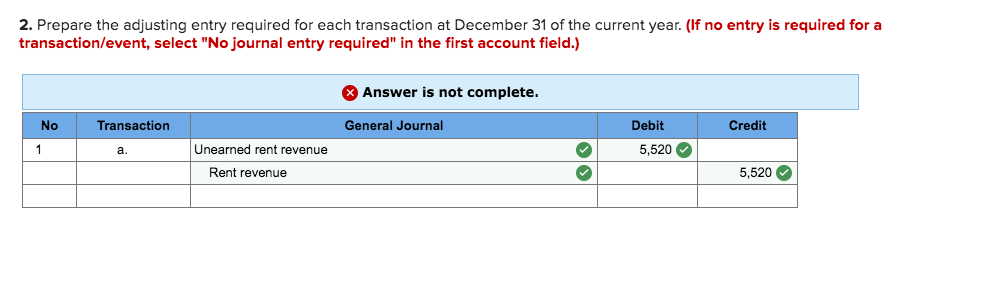

Here are some of data try to assemble just before meeting with a home loan specialist and you can applying for a property collateral loan.

To possess instructional service and other low-framework motives:

- A few kinds of valid Photo ID (passport otherwise national term cards, driver’s license)

- Proof of permanent address (elizabeth.g., a computer program statement)

To possess design/restoration strategies:

A number of the documents necessary will vary of the legislation. RBC offers a whole number away from records because of the country that may be found right here:

Your home collateral is usually your most significant and you can versatile monetary possessions. To find out more concerning your options for being able to access your home guarantee, talk to your home loan specialist.

This information is required given that standard pointers just which can be not to be relied abreast of once the constituting courtroom, financial or any other expert advice. A specialist coach should be consulted about your particular problem. Information presented is believed to get truthful or over-to-go out however, we really do not be certain that the accuracy and it also should never be considered a whole study of your own subjects chatted about. All of the terms out-of thoughts americash loans Sumiton echo new view of one’s people since the of one’s day regarding publication and are susceptible to change. No acceptance of every businesses otherwise their guidance, opinions, information, products or services is actually expressly considering or intended of the Regal Bank from Canada otherwise any of its affiliates.

Scrivi un commento