Commercial mortgage loans come into brief terms of step 3, 5, and you can ten years. Anybody else extend as long as twenty five years. In standard, commercial mortgage terms and conditions are not provided very domestic finance, which is usually thirty years.

In terms of the fresh new payment framework, expect commercial funds to vary on traditional amortizing agenda. A lender requires a borrower to spend the full financing shortly after several years having a lump sum payment. It is named a good balloon commission, for which you afford the complete left balance by the end regarding the newest conformed term.

As an instance, a commercial financing features an effective balloon commission due from inside the a decade. The newest percentage is based on a traditional amortization agenda instance a thirty-12 months loan. Generally, you pay the initial 10 years regarding dominating and you will interest costs according to research by the complete amortization desk. While the term ends up, you make the fresh balloon fee, hence takes care of the rest balance on the home loan.

In addition, you’ve got the choice build desire-simply money inside a professional mortgage. This means you don’t need to to consider and make dominating money for your identity. Concurrently, since financing term is with, you should settle people kept equilibrium which have an effective balloon commission.

In some cases, industrial loan providers bring fully amortized funds so long as 20 otherwise 25 years. And you may with regards to the industrial mortgage and bank, particular higher industrial mortgage loans is generally given a phrase off forty decades.

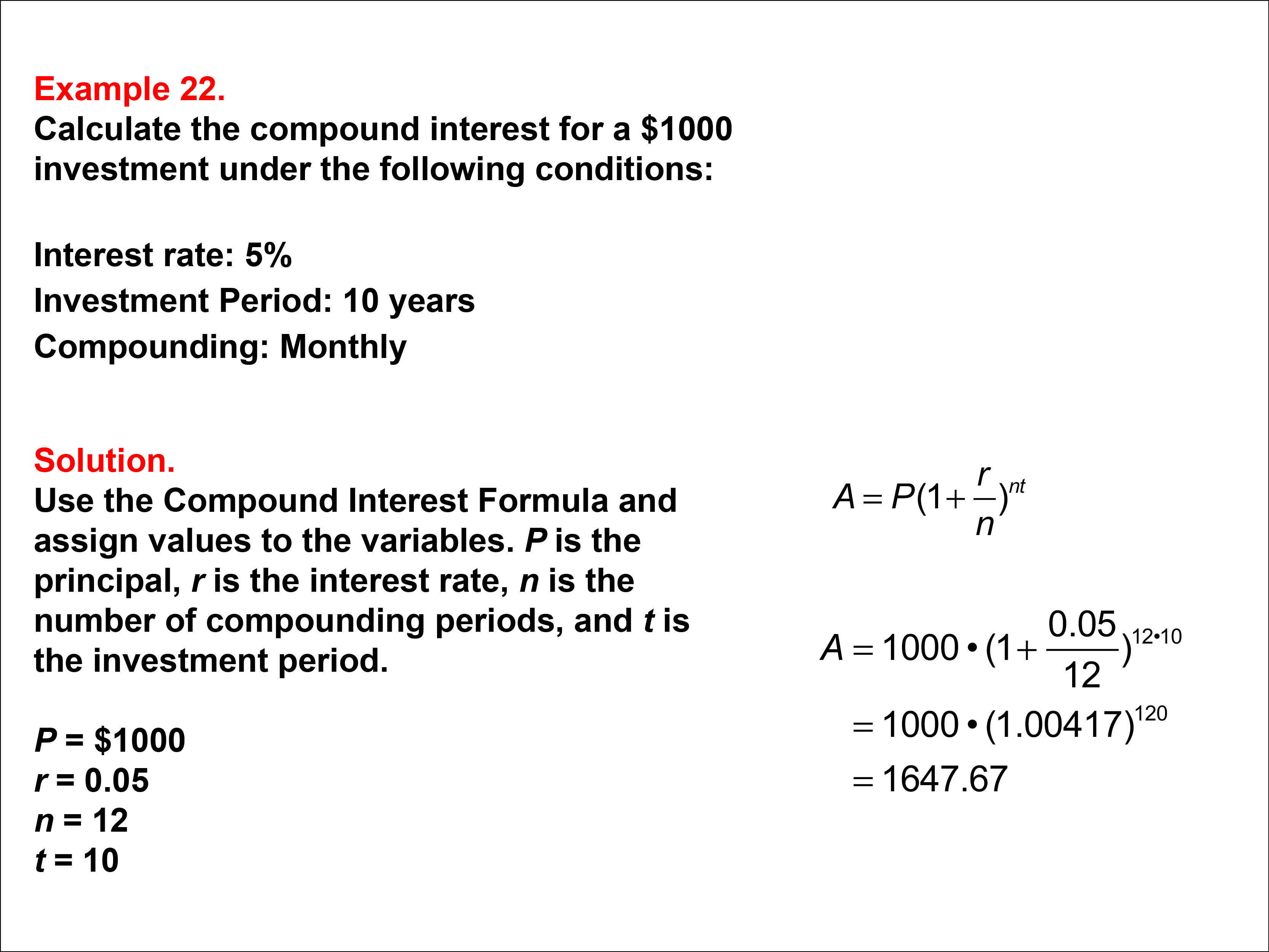

Industrial Loan Fees Example

Understand how industrial payments functions, let’s feedback this example. Let’s assume the commercial mortgage loan is $2.5 billion having 9 percent Apr, which have financing label out-of ten years. Let’s make use of the calculator on top of this page to guess the payment per month, interest-just fee, and you may full balloon fee.

- Commercial amount borrowed: $dos,500,000

- Interest: 9% Apr

- Term: a decade

Depending on the performance, your own month-to-month commercial homeloan payment might possibly be $20, to own a decade. If you choose to create focus-just costs, it will just be $18, monthly. Given that ten years is right up, you must make an effective balloon percentage away from $2,240, to pay off your own left equilibrium.

Often, you do not manage to build a good balloon payment for the the industrial home loan. If you’re concerned about decreased finance, refinance until the avoid of your own identity. Begin inquiring regarding refinancing about per year until the label finishes. This can help you save of foreclosures and you can dropping your own lender’s trust. For individuals who standard on your financing, they means not so great news to suit your credit rating, so it is difficult to get acknowledged having upcoming commercial finance.

Industrial refinancing is simply taking out a unique home loan. This will help to you reconstitute the percentage to your an expense you can afford. it enables you to decrease your interest and take a workable percentage title. To refinance, you ought to plus fulfill lender certification. Loan providers run criminal record checks on the individual and you may organization credit hard money personal loans Kansas rating. They will certainly including query how long you’ve had the possessions.

Commercial A house Interest levels

Commercial loan cost are often some greater than residential mortgage loans. It certainly is as much as 0.25 % to help you 0.75 per cent high. Whether your possessions means more energetic government like a hotel, the pace can increase. Depending on the business and type from financing, commercial home loan costs generally are priced between 1.176 percent as much as twelve percent.

Industrial a home finance was rather experienced illiquid property. Rather than residential mortgage loans, there are no structured supplementary areas to possess industrial loans. This makes all of them more challenging to offer. Thus, high rates is actually tasked for purchasing industrial possessions.

Scrivi un commento