Generally, borrowers just who purchased their home immediately after 1990 will not have in order to repay the federal government when they foreclose to the house.

A Va loan is different from most other authorities-backed mortgages, instance an FHA financing or USDA mortgage, in a number of different ways. Particularly Va money, FHA and USDA finance was secured from the federal government – possibly the new Federal Construction Management and/or You.S. Agency away from Agriculture.

An element of the difference between Virtual assistant funds and you can FHA financing is the fact FHA money usually want a debtor to take out financial insurance coverage. The borrower needs to afford the mortgage insurance on existence of one’s mortgage. FHA loans also provide large advance payment requirements than just Virtual assistant loans.

A significant difference ranging from Virtual assistant loans and you can USDA funds ‘s the style of household you purchase. USDA money are made to prompt homeownership inside the rural otherwise suburban section. For individuals who get an effective USDA mortgage, you simply cannot purchase a house in the city otherwise an incredibly created town.

The cause of one’s fund also can are different. Certain USDA financing come directly from government entities, when you find yourself private loan providers fundamentally procedure Virtual assistant and you will FHA money.

Do Va Financing Take extended to close?

The new Va credit processes will not take longer than the traditional financial techniques. The typical time for you to romantic to possess old-fashioned and Va fund is actually a similar – in the forty-two months. Virtual assistant financing also have a slightly high closing speed than just old-fashioned funds, on 70% versus 67%.

Which are the Requirements and you will Words getting a great Virtual assistant Financing?

Virtual assistant fund aren’t available to all the consumers. Beyond meeting the service qualifications standards, you could also have to meet money requirements to help you be eligible for that loan. Financial support criteria can differ from lender so you’re able to financial.

Exactly what are Va Funding Conditions?

Since the Va approves personal lenders so you’re able to topic extremely Va financing in place of giving the latest loans myself, those people private loan providers usually expose one resource requirements for borrowers. not, they might legs its investment requirements for the suggestions in the Virtual assistant.

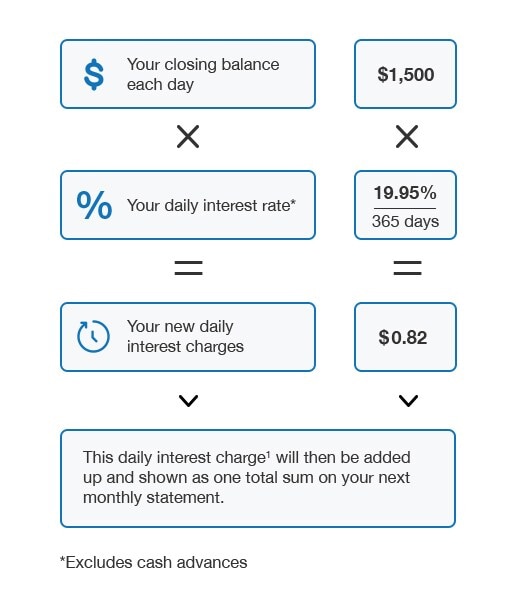

Like, a loan provider tends to check your income when choosing simply how much you could use. They are going to fool around with a financial obligation-to-money (DTI) ratio to decide if you can be able to build payments on the the loan. The latest proportion compares what kind of cash you entice in order to the amount you have to pay to the financial obligation, such as your financial, car and truck loans and other costs monthly.

When you find yourself there isn’t any real upper maximum towards the financial obligation-to-earnings ratio, 41% appears is a fixed rate loan better to be the newest magic count for almost all Virtual assistant lenders. When the a lender agrees to allow anyone borrow enough that its debt-to-money ratio is more than 41%, the financial institution needs to promote a compelling reasons why.

Similarly, the newest Va does not have any strict standards out-of good borrower’s credit rating and you can score. However, a loan provider you will. Including, a lender you are going to select never to agree an experienced that have a credit history less than 600.

Generally speaking, Virtual assistant funds not one of them a downpayment just like the Va in itself claims new financing. Even though a borrower can pick to place some money off when purchasing a home, of several don’t. Almost ninety% of all Virtual assistant funds is actually provided without an advance payment.

With traditional mortgage loans, the recommended advance payment is frequently 20%. While it is you can easily discover a traditional mortgage that have less overall down, borrowers just who set-out shorter typically have to pay personal financial insurance (PMI) and better rates. That isn’t the actual situation having an excellent Virtual assistant mortgage.

Do you want Financial Insurance coverage having good Virtual assistant Mortgage?

Certain lenders need a borrower to get private mortgage insurance rates in certain situations, eg a conventional financing whenever a guy places off reduced than 20% otherwise an enthusiastic FHA loan. PMI protects the lending company, since it backs the borrowed funds and will coverage costs in the event the a great borrower non-payments.

Scrivi un commento