With rates increasing, of a lot property owners was reluctant to create significant choices where their homes are worried. Should it be that loan for purchasing property, building work, otherwise refinancing, highest interest rates create tough to know when and how to invest cash in your household.

At Lamont Bros., our team off restorations advantages enjoys navigated these types of erratic market cycles just before. In present state, there are certainly a lot more challenges to consider before you make a primary a mortgage decision. Yet not, according to the proper situations, you are able to large rates to your benefit.

This article will speak about just how higher interest rates make a difference a beneficial home building work financing. Once you end discovering, you’ll have a strong knowledge of just what choices are offered to you in addition to most useful thing to do for your certain state. Subjects we will coverage in this article include:

Exactly why are interest levels going up?

Rates are located in the news a lot from the latter half 2022. With number-form expands, a lot of homeowners and you will homeowners find themselves reconsidering if or not today ‘s the right time to acquire otherwise redesign a home. But what precisely is happening which have mortgage prices, and just why?

Housing industry Woes

Inquire anybody having attempted to purchase a property in the last 2 years and they will let you know exactly the same thing: to get a property is actually a horror in today’s market. Since a response to the newest COVID-19 pandemic, government entities quicker rates of interest inside the 2020. During this time, 30-seasons mortgage pricing hit 2.68%, a nearly all-day lower.

From 2020 so you can 2021, home prices rose take a look at this website because of the 22%. From the 2022, brand new Western housing market is actually characterized by shockingly highest rates, fast household offering, and you will putting in a bid wars. Accepting you to definitely anything needed to be done to handle ascending family costs and you may inflation, this new Government Put aside Board began enacting measures so you can sluggish the latest homes market’s development.

Rate of interest Hikes

Within the , the Federal Set aside established this would begin to raise government interest rates, hence impacts brief-label financial support cost for example playing cards and you may car loans. Additionally impacts mortgage cost, though a lot less directly.

New Fed began from inside the that have an excellent .25% speed hike. Numerous more rates nature hikes observed, by , interest levels was indeed up step three.75% inside 8 months, the fastest speed out of increase in Western record.

Even though government rates of interest cannot physically apply to home loan rates of interest, they actually do involve some dictate. Anywhere between , financial prices mounted from 3.76% so you can eight.08%.

But how would Interest levels Affect the Housing industry?

Ascending interest rates drive within the cost of owning a home. Brand new month-to-month homeloan payment towards a good $600,000 home with mortgage out of step three% create costs from the $2,five-hundred four weeks. A similar house with an interest rate out-of seven% carry out pricing $cuatro,000.

Whenever interest levels push upwards household get rates, a lot fewer some one have enough money for buy one. That it decreases demand, which in idea would be to eliminate home values. At the time of , one to principle appears to be holding real, due to the fact mediocre home prices has dropped the very first time within the two years.

What exactly are my personal Alternatives for Investment property Renovate?

Higher rates may have a primary effect on which mortgage possibilities maximize experience when remodeling your home. Check out of the very prominent recovery loan options available.

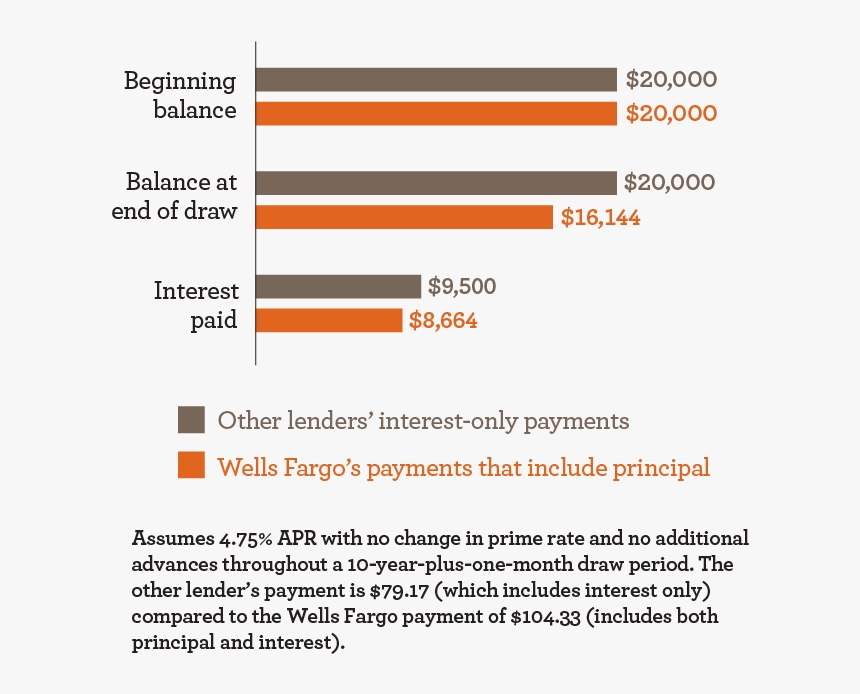

Household Security Mortgage / Credit line

One benefit out-of a housing market growth would be the fact property make guarantee right away. The typical family has increased when you look at the well worth from the 35% within the last 24 months. More often than not, people use the guarantee in their house to fund a renovation project.

Scrivi un commento