Finding the best lot and building a moment house is a dream that will come true. Even though, finding a minimal deposit 2nd domestic build financing was a great little more difficult. Luckily for us, we provide design perm funds to construct a holiday family. Whether you possess homes currently or are interested residential property and generate, we offer up to 90% resource. Although to own current landowners, it is possible to make the second home with zero down payment.

Construction Loan Down-payment

Though, strengthening an initial house is just 5% down-payment (zero downpayment to have Va qualified individuals), another family framework financing lets only 10% down payment. Second household deposit for new structure may come out of several source including…

- Package security

- Examining, discounts, or other bank accounts

- Later years loan or liquidation

- Gift finance to pay for closing costs and you may one thing once borrower’s minimum 5% off

- House equity mortgage up against primary house

Build with the Own Parcel

Present landowners have a very good advantage because it allows an enthusiastic owner to use the newest as the completed value unlike rate. Having said that, to get much having a construction mortgage need utilizing the parcel in addition to build cost. Then 10% down-payment try put on the complete rates. Even though in case the home try possessed only 1 day, the borrowed funds is founded on the fresh as the complete value unlike the price. Even that have a loan toward a great deal is ok, it would just need to be paid out-of during the build closing.

For this reason a home one appraises to own more than the price, lets the master to make use of brand new security because the down-payment! If the property appraises for enough, possible are the settlement costs and you can render zero currency in order to closing. Therefore, if there is sufficient collateral in which borrowing up to ninety% of your own while the finished really worth talks about what you, it can be no cash to close off. Another advantage is the appraised well worth known up until the design closure as the appraiser appraises brand new land together with agreements upwards-side.

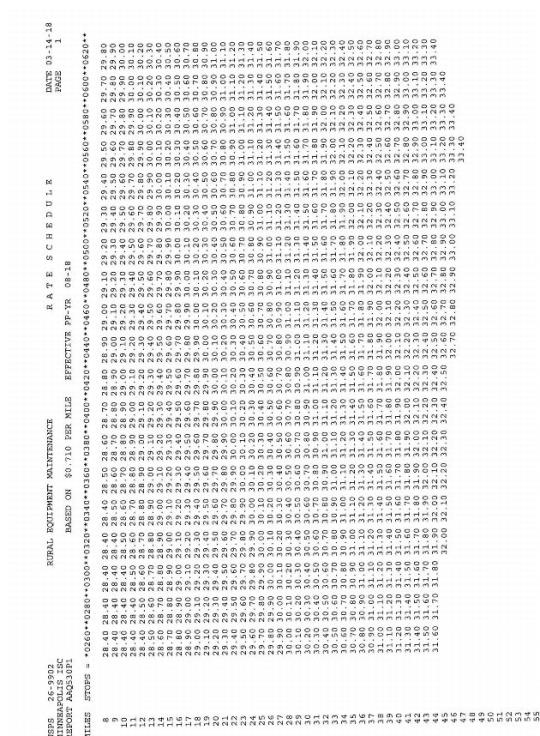

Potentially from year to year, conforming Fannie and you may FHA loan limitations increase to follow along with household rate grows. Now, 2020 compliant financing constraints possess surpassed 500,000 bucks. Very, you’ll acquire doing $510,eight hundred to possess building one family home. Take a look at graph lower than that presents just how much highest the fresh new 2nd home generate pricing is while existence for the conforming financing constraints!

2nd Domestic Construction Loan Costs

In terms of strengthening one minute house, the fresh new monthly payment is vital. Though there are several things that make up the mortgage payment, the interest rate is one of the keys. While you are building a https://paydayloanflorida.net/bushnell/ vacation household, discover 3 interest rate options.

- Interest Cap Establishes the most interest

- Offered Price Secure as much as 180 weeks immediately following construction closure

- Floating Constantly simply put if the playing with a two-date structure perm closing

Determining and therefore price selection works well with a borrower relies on multiple items and for you personally to build the home, newest interest rates, as well as how painful and sensitive the fresh new debtor is to moving prices. As an instance, delivering longer than six months to construct would mean making use of the speed cap solution. In place of leasing possessions interest levels, second financial pricing usually match top household prices.

2nd Family PMI

Extremely don’t like to learn PMI within its mortgage payment. Yet, financial insurance rates enables people to build, get, or re-finance more 80% of appraised really worth. Today, PMI pricing are extremely reduced. Particularly for consumers with high fico scores and you will low debt so you can income rates. PMI selection I otherwise purchasing it up-front. In the long run, stop PMI completely of the placing off 20% otherwise that have 20% security on possessions (in the event the already is the owner of the new lot).

In the event that strengthening your second family or travel leasing tunes fascinating so you’re able to you, give us a call to use all of our next domestic framework mortgage to simply help loans building your perfect vacation destination!

Scrivi un commento