Content

Every Federal Housing Administration (FHA) money wanted financial insurance policies. Homebuyers shell out two types of mortgage insurance rates when selecting a home having fun with a keen FHA loan.

First, you pay an upfront Home loan Insurance premium (UFMIP), a single-date percentage paid down at the closure. Next, you only pay a month-to-month Home loan Cost (MIP), a continual charges paid in monthly premiums.

The price of financial insurance depends on the borrowed funds number, down-payment, and loan label. In this post, I will make suggestions how much cash FHA financial insurance costs, how to estimate it, whenever you might terminate it.

Please have fun with the FHA mortgage calculator to explore the selection. You can evaluate latest rates, costs, and you can settlement costs on the internet, 24/seven, so you’re able to choose the best mortgage to your perfect domestic. Use the FHA Home loan Calculator now.

Exactly why do you pay FHA financial insurance policies?

Financial insurance rates handles the lending company against losses if not pay off the loan. In return for investing mortgage insurance policies, the financial institution helps make providing accepted having a home loan to find a great household convenient.

With an enthusiastic FHA financing, you might fund the acquisition of one-relatives, condo, townhome, or dos-to-4-unit assets that have an advance payment of 3.5% of the purchase price. FHA money normally have a lower down payment requisite than just old-fashioned ones, making it easier to afford property.

Advance payment requirements-FHA vs. Conventional

- Down payment having FHA loan

- Deposit getting a traditional loan

Along with, you can aquire recognized to have an FHA mortgage in the event that lender perform otherwise refute your application to own a traditional mortgage. Due to the fact FHA loans are simpler to be eligible for than just old-fashioned financing, you may have a far greater risk of getting recognized getting an FHA mortgage when you have minimal borrowing from the bank or savings.

Also, you can get alot more personal debt and you may a lowered credit rating and you may appreciate cheaper payments than a normal home loan. FHA finance usually have way more easy debt-to-income proportion requirements, so that you may be eligible for a keen FHA financing regardless of if you really have increased debt weight. FHA fund also provide a lot more versatile credit history requirements, so you might rating an FHA financing even though you keeps a lower life expectancy credit history.

Restrict financial obligation-to-earnings ratio and you can lowest credit score-FHA compared to. Conventional

Complete, an FHA financing can be advisable for buying a house if you have a diminished credit score, a smaller sized advance payment, or have to take advantage of its a great deal more easy qualifying criteria. But not, I shall define later on one FHA financing also provide certain limits and you will standards, such as for example straight down mortgage limits and you will financial insurance premiums than simply old-fashioned loans.

You could borrow much more with a normal loan than simply that have an FHA loan. This is loans Haxtun because the standard conforming financing limits go for about thirty five% more than the fresh new FHA limitations.

2024 financing restrictions-FHA compared to. Old-fashioned

- FHA financing limits having 2024

- Compliant mortgage constraints to possess 2024

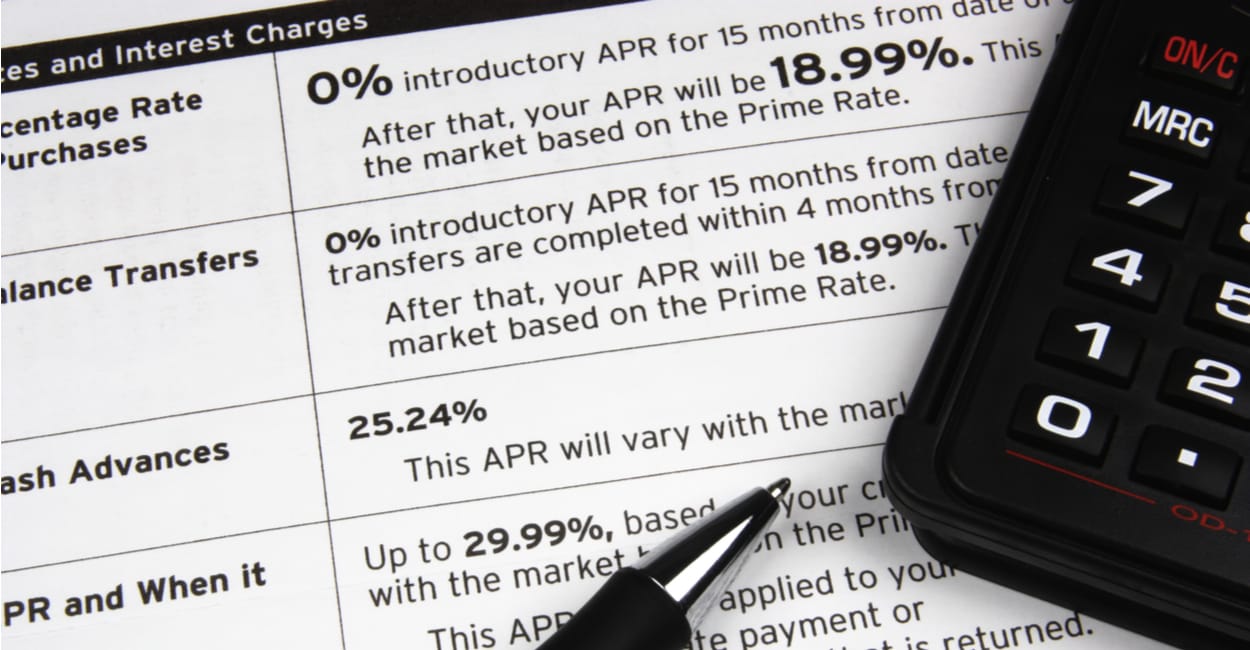

How much cash ‘s the FHA Upfront Financial Advanced (UFMIP)?

FHA charge an initial Financial Insurance premium (UFMIP). They costs step 1.75% of your loan amount. The financial institution exercises the UFMIP, accumulates they away from you from the closure, after that ahead they so you’re able to FHA.

The financial institution will provide you with a loan Estimate complete with the amount of the newest UFMIP you’ll need for your loan. Meanwhile, you can utilize our very own closure pricing calculator to imagine your own closure can cost you, such as the amount of new UFMIP.

Really homeowners funds the fresh new UFMIP by adding they for the financing count. Such, what if the loan count is actually $100,000. This new UFMIP could be $1,750. So, their overall loan amount once investment the new UFMIP are $101,750.

Scrivi un commento