Pre-Approvals

View here to start this new pre-recognition procedure. You may love to complete an entire app for many who have previously discover the house you are searching buying.

For those who have questions, you could potentially finish cashadvanceamerica.net/personal-loans-il the means below to get hold of a mortgage Administrator, you can also contact a person in our very own financial class in person.

You will find several home loan hand calculators available which can offer you an idea of what kind of cash you might use. Although not, observe the true number and you will speed which you qualify for, just be sure to get borrowing removed.

You really need to just begin the latest pre-approval processes if you are totally ready to look for a house and that means you try not to too rapidly pull the borrowing from the bank. You might speak to an enthusiastic MLO any time for further suggestions. We supply a mortgage Bank account to save your self month-to-month and you may secure doing $step one,000 step one to your closing costs after you money your own financial that have HVCU.

You need their past a few paystubs, W2s during the last 2 years, two months of all the lender statements (all the users), and a signed price out of income to possess a buy.

First-Big date Homebuyer

The sort of financial hinges on each borrower’s condition. We offer numerous high choices click on this link to explore next otherwise speak with a mortgage loan Manager for much more information.

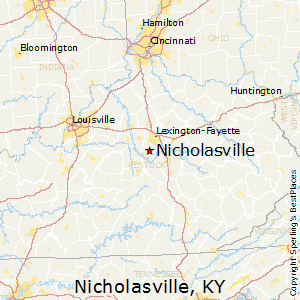

At HVCU, we provide the fresh new Homebuyer Dream System, that provides around $ten,000 toward a first come, very first offered foundation. It’s also possible to contact the newest condition housing organizations where you reside observe exactly what grants are available in your neighborhood.

Having a smaller sized downpayment, you I) yet another bills to take on. Be sure to consider whether or not there’ll be fund just after getting the home. It certainly is smart to plan to come and also have more currency set aside if your unforeseen goes.

The true deposit matter may vary based what program and kind of financing best suits your position. Certain very first-day homebuyer apps may require as low as 3% down (if you don’t 0% down), but as an excellent rule of thumb, you should thinking about having somewhere within 5-20% of your own ordered speed stored.

Closing costs may be the mixture of various characteristics and you can costs, which often include realtor earnings, fees, label insurance rates, or any other standards needed to processes and you will finalize their home loan. These types of costs may vary regarding one state to another, but they are commonly ranging from 3% and 5%.

Usually all of the settlement costs together with attorneys charge and extra will cost you necessary to romantic the mortgage is actually paid off within closing table. Home inspections, appraisals, and you can credit file charge are paid-up top during the time away from solution.

Buying property often means alterations in your monthly expenses. You ought to remember to is cover your homeloan payment if you are nevertheless keeping a lives you may be happy with whether this means traveling, going to the films, or weekly restaurants dates. Put simply, you dont want to become strapped for money. It is important to contemplate the additional expenses that include running a property: scrap come across-upwards, utilities, lawn care, heat, snow treatment, an such like.

It is not precisely the cost of the home that can feeling cost. With huge house, you can find always higher expenses associated with resources, restoration, plus assets and you may college or university taxation. Definitely take all for the under consideration.

Your own Real estate loan Officer can perhaps work along with you to assist dictate just how much ties in your budget. Definitely envision coming agreements which can affect the cost of commission. You can also find a fundamental thought of the payment matter that with one of the home loan calculators.

Scrivi un commento