Standard belongings are a good financing on the upcoming, but like most a investment setting it up takes a little effort and frequently loads of paperwork. If you’re searching for a modular house, you’re likely together with looking the way to buy it. Here are some different choices to possess financing modular homes.

1) Government-Supported Construction Fund

Government entities backs several kinds of loans to have prefab land. The fresh new FHA loan now offers fund to help you modular home developers whose borrowing get otherwise down-payment matter avoid them out of acquiring a conventional financial. At the time of publishing, to satisfy the needs of an enthusiastic FHA financing, prospective standard domestic builders need to have a credit history from from the least five-hundred, that’ll wanted a 10% advance payment, otherwise a score away from 580 or more than to attenuate one to down commission to three.5%. In addition, you will need to offer recorded proof of a job, income, possessions and you may liabilities. The house or property you make with the will also have to get appraised and you may authorized by the FHA. For everyone FHA structure fund, buyers exactly who render lower than 20% off will have to pay home loan insurance, an unavoidable trading-off of the low-down commission. It is an effective choice when you need to generate a standard household nevertheless do not have the ideal credit rating otherwise an effective hefty bank account.

A different financing is the USDA financing, that’s good for lower-income generating developers from prefab belongings that prepared to alive when you look at the an outlying area. When the approved, that it financing are 0% off. Due to the fact Second Modular also provides various modest, sensible standard virginia homes in the rural Indiana and you may Michigan, that one is really worth looking at!

While you are a good All of us veteran, an effective Virtual assistant modular house structure loan is a great option as the its 0% down, needs no mortgage insurance coverage, and you will preserves competitive rates. This new Va notices modular homes for sale like it would an adhere-oriented household for sale, so it won’t be difficult to find a housing financing. Both the USDA mortgage together with Virtual assistant financing have to have the same proof work and money record as the an enthusiastic FHA financing. I have founded matchmaking with advanced lenders that are ready to take you step-by-step through the process and help you have made financed, so contact us right now to begin funding your own modular home.

2) Antique Framework Financing

If you have a nest egg open to use due to the fact a deposit, along with your credit rating is actually pretty good to good, a normal, otherwise conventional build loan is probably good for you (find out more from the construction funds here ). Once the a potential modular house builder seeking to a conventional home loan is usually capable spend a larger downpayment and it has an effective good credit get, he or she is considered all the way down-risk. Of a lot banks are prepared to conventionally loan the cash for standard homes as the homeowner enjoys good vested demand for maintaining brand new family and you can to stop property foreclosure, and since he’s most likely building a forever home or at least want to inhabit it an extended if you find yourself. Obviously, people lender is about to ask for many research of financial viability, but they will certainly promote a realtor so you can see and fill in all files. Expect you’ll find and deliver this type of bits of information that is personal:

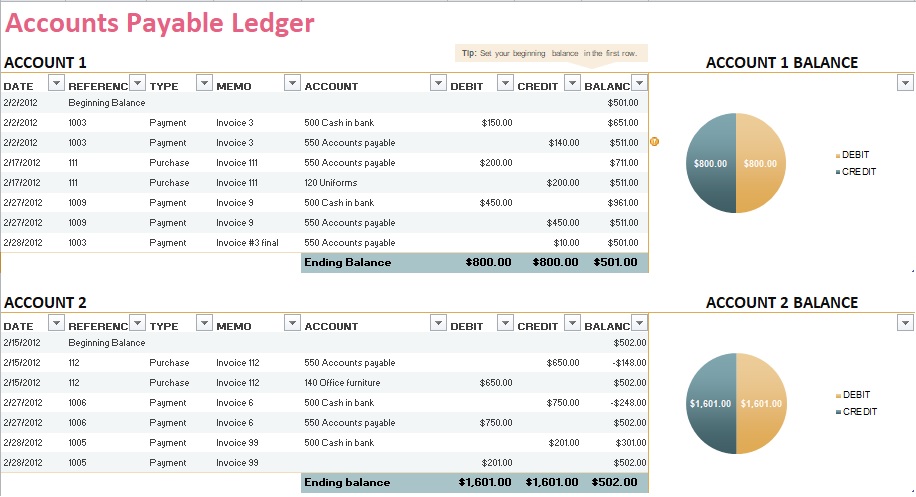

- The personal loans declaration, that’s a file that provides the bank a picture off debt really-are. You can record your earnings and you can assets, financing, monthly obligations and you may debts.

- Employment confirmation. You can easily bring their employer’s email address therefore the financial is also ensure your a worker inside the loans in Hotchkiss without bank account a-condition.

- Paystubs and financial statement, will for the past few months, to make sure youre making a profit continuously and are generally in a position to help save consistently.

- Federal taxation statements, tend to for the past 2 or 3 ages. The financial institution desires a more impressive image of debt background so you’re able to enable them to determine the best loan amount they may be able give you.

- Credit report. You will need to signal a permission setting toward lender so you can get your statement.

- Other proofs out of viability. You may be expected in order to file most other revenue, such as a keen SSI commission, child support or proof of earnings generated on income off a previous family.

3) Spend dollars

That one isn’t really readily available for most of the standard domestic designers, in case you can, its hands-on the easiest choice. If you have ended up selling property consequently they are now standing on a big funds, a money purchase will get you towards some of our prefab home on the price range versus a hill from records. For the greatest process possible, you need 100% dollars toward get. You can also determine one to strengthening a far more modest standard house or apartment with the cash you’ve got is worth more for your requirements compared to difficulty off getting a home loan to possess a bigger home with even more business.

Next Standard knows that going for how you’ll funds your standard house was a decision that may perception everything somewhat. We’ve the experience and you can training to guide you through this processes that assist you will be making the best choice to suit your future. Give us a call today from the (574) 334-9590 for more information.

Scrivi un commento