Really does Texas allow cash-aside refinancing?

Regardless if Colorado dollars-aside re-finance legislation try a little diverse from in other states, these are typically not because tight as they used to be.

As long as you has actually very good credit and most 20% household security, just be able to refinance the financial and you may remove bucks out of your house. And with high guarantee levels all over the country, of a lot Texans commonly easily satisfy men and women standards.

How come a texas bucks-out re-finance functions?

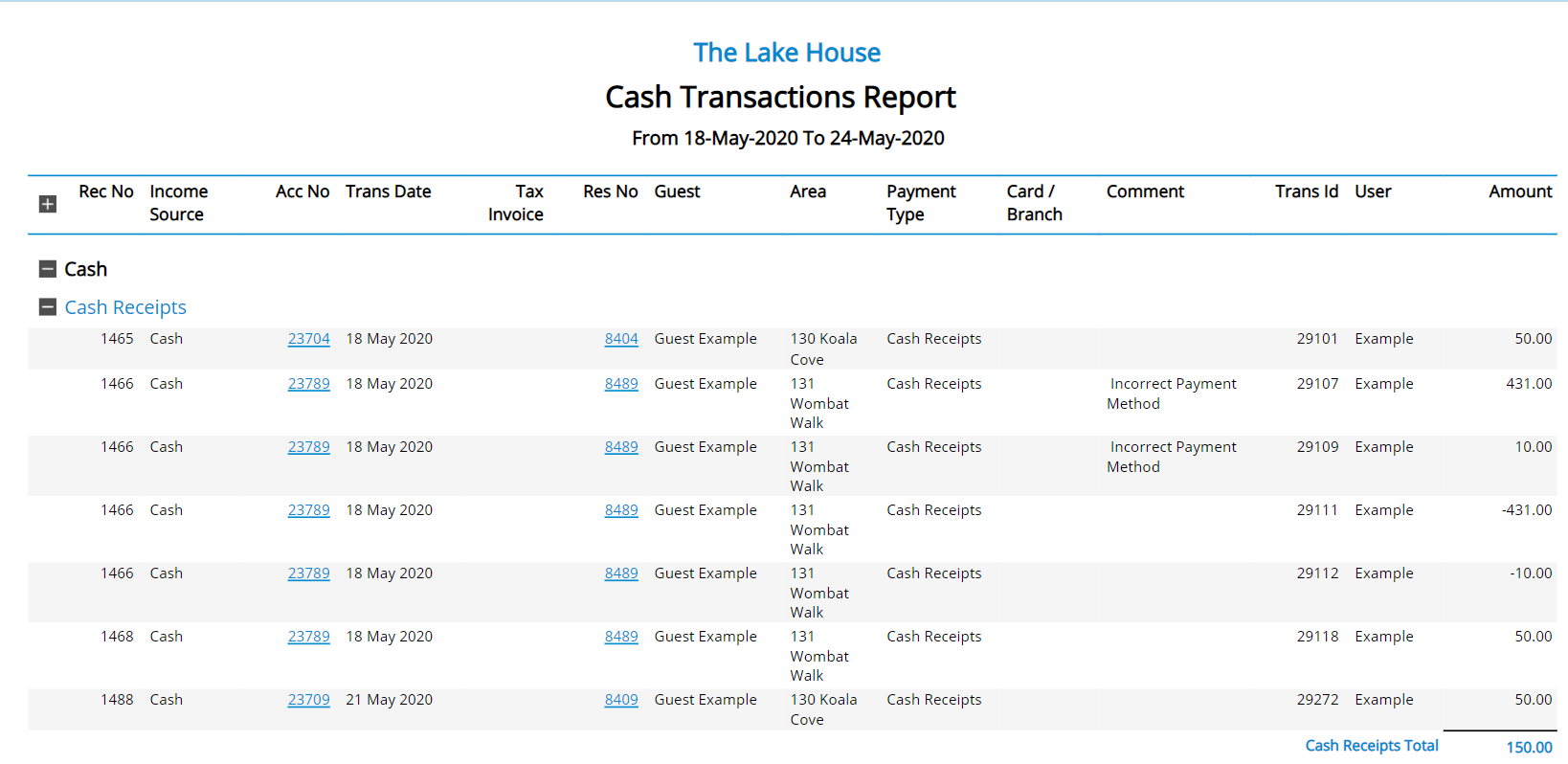

Cash-away refinancing into the Texas work somewhat in different ways off their states due to specific laws and you may recommendations lay by the Colorado local government. I mention this type of laws and regulations in more detail less than.

A colorado bucks-out refinance is additionally named a paragraph fifty(a)(6) loan, or maybe just a keen A6 loan. They changes your existing home loan with a brand new, huge mortgage, allowing you to availableness a portion of their residence’s equity since cash.

Much like any cash-aside refinance, you obtain more than you already owe in your mortgage, while the difference between the outdated financing balance therefore the brand new amount borrowed is offered for your requirements due to the fact a lump sum. This will impact their monthly premiums, because the the fresh amount borrowed is greater than your early in the day mortgage harmony.

You can utilize the income for how do i get emergency cash from direct express everything you such, but typically they are useful for purposes instance renovations, debt consolidating, and other financial need.

Colorado cash-out refinance rules and advice

People homeowner is approved because of it Tx cash-aside refinancing mortgage. You simply need to are entitled to more than 20% security in your home, claims Plant Ziev, an official Financial Thought Professional from inside the Colorado.

- Closing costs try not to surpass dos% of the amount borrowed. It doesn’t affect 3rd-cluster settlement costs instance attorney costs, appraisal charge, name insurance premiums, and you can home loan insurance premiums. They enforce just to costs recharged by your lender eg mortgage origination and you will control fees

- The new amount borrowed cannot exceed 80% of one’s residence’s worth. Which means you should log off 20% guarantee unaltered whenever cashing out. Including, if your value of your home is $2 hundred,000, you might use around $160,000. For many who owed $120,000 in your existing mortgage, you could potentially obtain as much as $forty,000 cash return

- All the liens (2nd mortgage loans) have to be paid. For people who currently have a house equity loan or household guarantee credit line (HELOC), the new cash-aside refi would need to pay-off these types of financing as well as your priount from collateral you are able to withdraw

- You will have to wait half a year in order to refi once initially to invest in the house. You may be eligible for a cash-aside refinance inside the Texas as long as you had your home loan financing for at least six months. Together with, you simply cannot rating another type of bucks-away refi unless it has been annually since your past you to

- Wishing minutes just after foreclosures, bankruptcy, or quick selling. You will need to waiting seven age shortly after a foreclosures, number of years shortly after a case of bankruptcy, and you may number of years shortly after a preliminary sales before you can be considered to have a tx fifty(a)(6) cash-aside refinance

- There are not any cash-away mortgages backed by the federal government. That implies there’s no FHA dollars-out refinance or Virtual assistant cash-aside re-finance allowed into the Colorado

- You can not pull out property guarantee financing or HELOC (2nd lien) for individuals who curently have a tx dollars-out financing set up

- Colorado cash-aside home mortgage refinance loan rules pertain merely to your primary home. Put differently, financing attributes and you may 2nd belongings are not bound by these types of guidelines

Ahead of 2018, Tx got also stricter limitations towards the dollars-away refinance loans to have farming assets. Newest laws and regulations provides eased this maximum, too.

Scrivi un commento