Whenever you are thinking about to invest in property however, concerned that you cannot meet with the minimum downpayment requirements, there is certainly very good news. Yes, there are reduce percentage selection than the simple 20 percent.

If you’re a 20% downpayment have typically come the quality for brand new homeowners, minutes has actually changed. Now, mortgage brokers bring numerous reduce percentage applications. You’ll find choices requiring as low as 5 %, step 3 percent or even 0 % down, plus earliest-date homebuyer programs you could potentially take advantage of. Given that minimum down payment varies by the bank and you can home loan system, let us view where the 20% advance payment contour comes away from.

When you are having increased down payment, you may be in addition to reducing the amount of cash that you will be borrowing from the bank a glaring, however, very important point. This helps to decide your loan-to-worthy of proportion (LTV), and this expresses just how much you’ll be able to owe in your financing once you shell out your own downpayment. Thus, increased advance payment output a reduced LTV proportion and you may mortgage loan providers consider carefully your LTV whenever giving the home loan software.

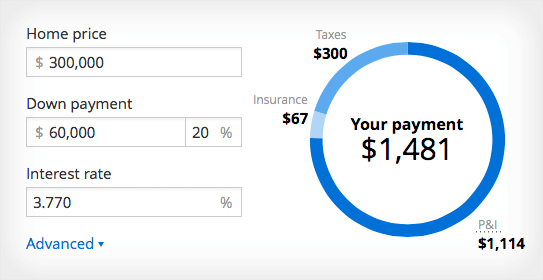

To help you teach just how their down-payment count could affect your month-to-month fee, browse the analogy below, and this measures up minimal deposit (5 per cent) towards the a traditional mortgage to help you a 20% advance payment:

One more reason many people go for a high down-payment are one to individuals exactly who spend lower than 20% within the home financing advance payment are usually necessary to buy Private Mortgage Insurance (PMI) towards the top of its month-to-month homeloan payment. To lenders, a beneficial PMI reduces the fresh thought of exposure.. Particular borrowers functions for this procedure if you take away one or two mortgage loans, the initial one to usually coating 80 % of the house rates on the 2nd one (also known as a piggyback mortgage) level 10 percent of the house price leaving 10% for an advance payment and no PMI demands. Piggyback finance are not due to the fact prominent as they once were, though, maybe since the present mortgage sector keeps so many viable selection so you’re able to pick, intricate lower than.

Choice #step one FHA Mortgage

You will find some bodies-backed, nonconforming finance geared towards helping lower income households and you will to make property less expensive, beginning with one to regarding Federal Property Government (FHA). FHA home loan applications are ideal for very first-time homebuyers, while they provide reduced down money and certainly will benefit individuals with all the way down fico scores. In fact, people may an enthusiastic FHA loan having a downpayment once the lower just like the step three.5 percent of the home’s cost, with regards to the You.S. Agency from Housing and you may Urban Invention, the fresh department one manages FHA.

But not, or even should pay home loan insurance policies, bear in mind one to FHA consumers will need to purchase FHA individual home loan insurance policies right down to not placing 20 percent down. This type of money usually continue for the life span of mortgage.

In a lot of towns, nearby or federal government even offers advance payment recommendations programs in order to renew elements struck tough by disasters or recessions. Even when it both possess earnings restrictions, residents usually are able to see advice if they discover in which to seem. Atlanta and you will San francisco are a couple of primary advice, even if these types of applications are not limited by larger places. They may be found in metropolitan areas, counties and you will states across the country. This means shopping around, getting in touch with the civil housing power and you will possibly dealing with home financing agent who’ll point your regarding the proper guidance. But do not limit your lookup to help you geography. Particular businesses and you may elite group teams render downpayment advice applications just like the well it never affects to inquire about.

Choice #step three Experienced Products (VA) Loan

Provided to energetic servicemembers and you may pros (including surviving partners), Virtual assistant finance try tailored so you’re able to military parents and supply completely capital. Not just that, depending on the Institution off Seasoned Factors, a great Virtual assistant financing will help consumers purchase otherwise refinance a property during the a low interest, often instead a down-payment. Regarding Va loan pros, consumers can get reduced settlement costs, assessment will set you back and you can financing origination charges. And additionally, people don’t have to spend PMI, it doesn’t matter what much down payment it spend, and also make Va money a far greater alternative than just FHA money within this admiration.

In order to qualify for a beneficial Va mortgage, potential homebuyers need meet particular service requirements and have now a beneficial credit rating, enough month-to-month money and a certificate out of Qualifications (COE).

Alternative #cuatro USDA Mortgage

Some other financing that offers 100 % financial support is the USDA Rural Property Loan, covered because of the You.S. Institution out-of Agriculture (USDA). Primarily built to remind homeownership inside rural areas, these types of finance are also made of cities (even though the department merely approves particular properties, meaning your decision should be USDA-qualified) and want zero downpayment. Similar to Virtual assistant finance, USDA money are reasonable, however, as opposed to Virtual assistant funds, they actually do wanted individuals to expend home loan insurance premiums.

Option #5 Antique 97

The conventional 97, made available from Federal national mortgage association and Freddie Mac, only needs an effective 3 % down-payment. This type of mortgage loans often have a bit higher minimal credit rating requirements, but old-fashioned 97 loans let the borrower to terminate PMI immediately following they arrive at 20% equity. An additional benefit? Borrowers are allowed to use gifted loans plus employer or church grants for everyone or part of the down payment.

Most other factors

Some loan providers give zero-PMI money, which means it (the financial institution) pay for the mortgage insurance policies. The fresh new monetary trade-from is you will get increased interest. This can be similar to the trade-away from that accompanies no deposit financing, which both means you only pay more charges in your settlement costs. Here are some our very own guide to home loan rates to see which form of fund and money down often connect with the costs.

As you inquire, Must i place 20 percent down on a mortgage? you should focus on the newest wide variety towards the monthly payment differences, weighing the advantages and disadvantages, right after which communicate with a trusted financing founder. https://simplycashadvance.net/personal-loans-hi/ They can assist you in finding the proper mortgage system that meets your position and see exactly how much to expend on your off percentage. Definitely inquire further on the other conditions, like average income levels, minimum credit history thresholds, limits about precisely how most of your gross month-to-month money can go to homes-relevant expenditures and you will debt-to-money ratio (DTI) criteria.

At AmeriSave, we could check your qualification in regards to our individuals loan programs and give you information regarding reduced deposit solutions, along with the the latter subjects.

Scrivi un commento