Still, “just like the PPP had ready to go, because the all those small businesses was able to look after some body with the payroll, i failed to comprehend the brand new tragedy that may availableloan.net/loans/low-interest-personal-loans have chosen to take lay had i were not successful,” Faulkender said. “What would bread contours during the a good pandemic has appeared as if? Will we would like to know? I did not. And therefore we were getting one program up and running.”

Echoing Kelley, Faulkender told you the SBA’s obligations were to incorporate the PPP rules enacted by Congress, not to ever concern congressional rescued many people off unemployment.

Other small-entrepreneurs interviewed because of the NPR indexed multiple reasons for with unforgiven PPP financing, plus taking crappy information from accounting firms, misunderstanding the newest program’s rules, and you will mistakenly thinking forgiveness are automatic

“Therefore off you to angle, I’m really pleased with the task that individuals performed in the Treasury,” the guy said. “My estimation given that a scholastic economist exactly who evaluates the applying? That’s a totally additional interviews.”

Elaborating, Faulkender asserted that, through the years, Congress changed the reason for PPP in a way that strayed from the amazing goal.

“At the front end, the application form try definitely let us conserve a career. After, the application appeared to morph for the why don’t we give assist with short companies,” he told you. “Though we needed to morph that into the much from small company provides, I could understand this that might be questionable.”

These kinds of individuals is actually interrelated, because that-individual people were likely to get their funds thanks to fintechs than just courtesy traditional banking institutions, which have been slammed having neglecting smaller PPP people in favor of large banking customers

Predicated on NPR’s analysis out-of SBA data, almost all end up in you to definitely-person businesses – enterprises the brand new Income Security System most meant to help – and folks whoever finance had been processed by the economic technology organizations, otherwise fintechs, a beneficial nebulous identity broadly identified as firms that use technical to help you automate financial features.

NPR discovered that the littlest enterprises – only holders eg barbers, janitors and you can hairdressers – hold the large price out of unforgiven loans, at thirteen%. By comparison, merely step three% of all the organizations with about ten team have unforgiven financing.

And also in December, an extended congressional report implicated numerous fintechs of quickly granting PPP loans to collect financially rewarding mortgage-operating fees, when you are ignoring noticeable signs of borrower swindle. At the same time, a course-step suit up against the fintech Kabbage, and that has just proclaimed case of bankruptcy, alleges it was short in order to approve PPP funds but fell the fresh new ball whether or not it found flexible them. Almost every other fintechs seem to have good backlog out-of forgiveness needs, too.

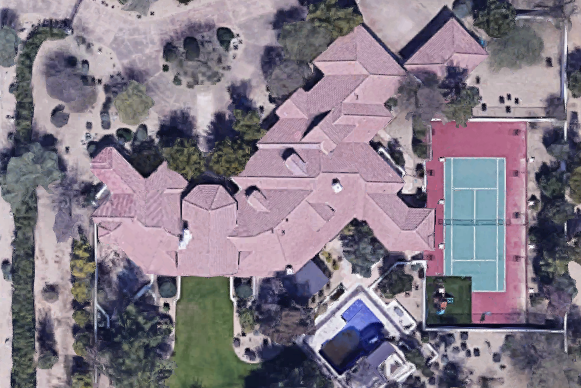

Chocolate Crawford, away from Handy Candy land, in a buyer’s backyard within the Provincetown, Size. She gotten good $step 1,022 PPP financing as a result of PayPal that has been later offered to another business. It grabbed this lady more than 2 yrs to have it forgiven. Kayana Szymczak for NPR cover-up caption

Candy Crawford, out of Handy Sweets landscaping, during the a client’s yard when you look at the Provincetown, Size. She received good $step 1,022 PPP financing due to PayPal that has been after sold to another team. They took the girl more than 24 months to get it forgiven.

In the springtime 2020, the woman smaller land providers, Convenient Sweets, had a good PPP financing off $step 1,022 using PayPal. She later on unearthed that this lady loan got marketed to another company, and it also ultimately grabbed her more couple of years to locate they forgiven.

“The degree of energy and you can date I invested! You need to share with these people, ‘Do your task!'” Crawford told you. “However you should be nice just like the you are on their mercy.”

Specific borrowers along with pointed out that when you are a busy small providers with no service professionals, you cannot subcontract work. That is the instance to have Katy Escher, which co-owns a keen Eastham, Size., store called ARTichoke and you can got an enthusiastic $8,275 PPP financing as a result of Square. Since the taking on problems with her forgiveness app, this woman is battled discover solutions.

Scrivi un commento