Maybe you have heard neighbors, household members, or loved ones talk about the 2nd home loan otherwise discuss the home security personal line of credit they simply shielded. If you’ve simply nodded your face inside confusion, you might be missing out on an opportunity to leverage your own home’s worthy of to fund a huge-ticket endeavor otherwise address an urgent situation finances. Let’s review the basic principles.

While thinking how the whole process of getting a property works, read our very own Complete Guide to Homebuying on a budget. So it invaluable resource has the benefit of everything you need to know about to invest in a home, out-of means your finances to maneuver-inside big date.

What’s household equity?

Family security ‘s the difference in new appraised property value their household while the amount you still owe on the mortgage. You to definitely difference between well worth are going to be borrowed in the form of house collateral financing or house collateral credit lines. Your house collateral loan and you can personal line of credit has book experts, fees, official certification, and created aim. Every standard bank is different, however, typically a loan provider cannot succeed a debtor to go beyond 80 to 85 per cent away from their particular home’s worth, and is also crucial that you know that in both cases your own residence is the fresh new equity with the borrowed fund. Particular loan read here providers may allow you to acquire so much more, even-up in order to 100 %, so research rates and you may talk about your options.

Domestic collateral ‘s the difference between brand new appraised property value your own home together with matter you still owe on your home loan. You to difference in value would be lent when it comes to family security fund otherwise house equity credit lines.

When ought i supply my personal home’s guarantee?

The answer is easy. As soon as you has actually collateral of your property, you can power you to value that have a property guarantee financing or personal line of credit. The actual only real prepared months you will have to undergo are the latest closing, which could simply take anywhere from 30 so you can forty-five weeks.

What is actually a home security financing?

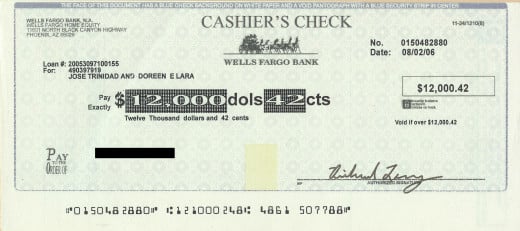

A home collateral mortgage, possibly described as an additional financial, is sent in a single lump sum, therefore so it is ideal for repair systems otherwise paying for an effective one-date knowledge instance a wedding. At the same time, particular love to pay back higher-interest-speed credit debt, and therefore transferring the debt to a lower life expectancy-attention choice and you may combining numerous repayments with the one easy month-to-month debts.

Another advantage of the property collateral financing is that they generally speaking offers a fixed rate of interest. Which have a predetermined rate, you will know what your costs would-be about lifestyle of your own financing and certainly will would a predictable monthly finances to satisfy their benefits goal.

What’s a house security credit line?

A house collateral line of credit is different from property security mortgage because it operates such a credit card and you will allows you to borrow cash as needed to an entire amount of the qualifying credit line. Which is something to believe to possess issues and investment short-identity means. You can make use of normally otherwise as little as you like, putting some family collateral credit line an extremely versatile solution getting individuals. This flexibility could well be high-risk if you aren’t particularly controlled regarding your bank account. A home security credit line enjoys a blow and you may a good fees several months. Because label implies, new draw months is when you have access to the amount of money on the credit line. Because fees months begins, you will cure access to that cash. Which have a house collateral credit line, its particularly important to possess a detailed cost bundle in position. It is really not unusual to suit your minimum fee inside the mark months to include appeal only while increasing within the fees several months whenever you begin investing toward dominant. Choosing to pay dominant above the minimum inside the mark months could help spread costs over the life of the new line of borrowing from the bank.

Credit out of your residence’s collateral to pay for college tuition, a home remodel, or even a crisis should be a good resource. Like most borrowing disease, it is essential to features reveal package in place to pay off of the loan and ensure a disciplined method to your month-to-month finances.

Scrivi un commento