Mortgages, Process, Cost More about the author, and you will Choice

To shop for a home, regardless of if exciting, are a challenging economic choice. Not all has a hill of money to acquire a family downright. Most home owners trust mortgages.

Considering Statistics to possess Mortgages 2023, 63% of people in the us features mortgages. Financial prices risen to 7.76% getting 31-seasons fixed-rates mortgage loans and you will seven.03% for 15-season fixed-price mortgages of the .

You ought to remember that credit money to own a home is actually a union one extends over a decade. Hence, it is crucial to understand how it works to quit concerns in the future.

Software

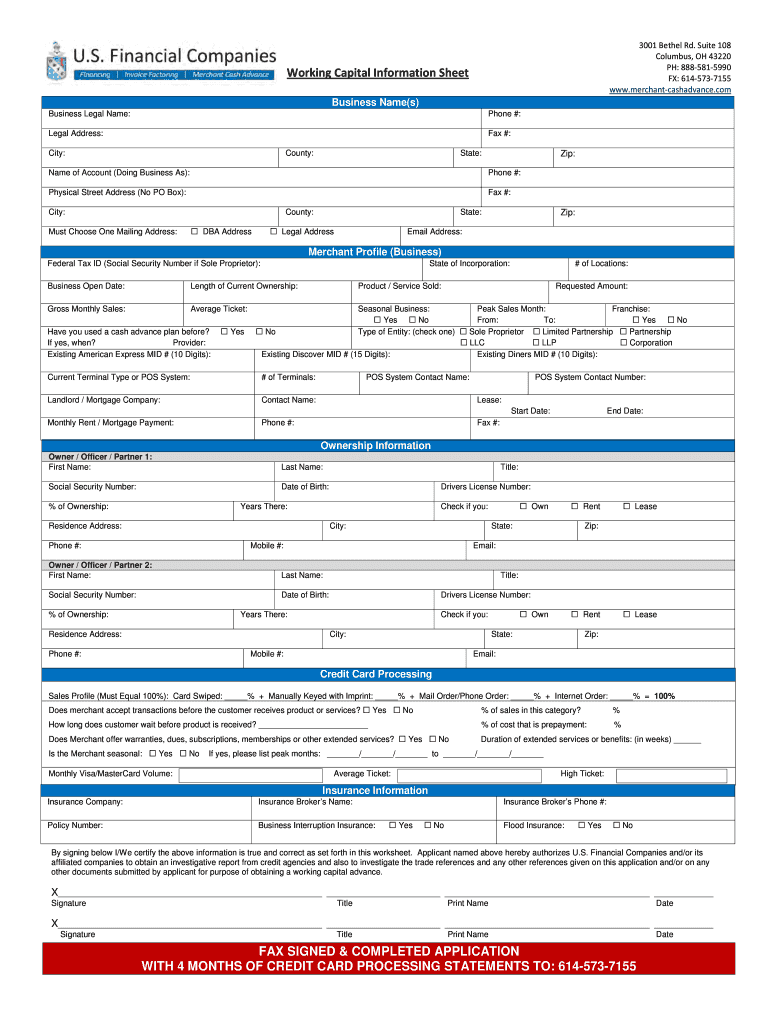

The initial step is to fill in a mortgage software. This is where you theoretically express your own intent so you can borrow cash to get a property.

- Detailed information regarding the financial predicament, work record, property, and you can expense.

- Your loan app knowledge underwriting a thorough comparison of work stability, income, and other financial items. Lenders need certainly to make certain you have the method for pay off the financing.

- You’re required to fill out various data files to show your economic features, such as for instance shell out stubs, taxation statements, lender statements, or other associated monetary information.

Pre-approval

With a mortgage loan pre-recognition, your code in order to suppliers and you will real estate agents that you’re a serious and you may licensed consumer.

- It will help place a realistic budget for your house look, save time, and give a wide berth to dissatisfaction more homes additional debt visited.

- Having been through particular underwriting process during pre-approval, the true loan running may be expedited. This might be such as for example beneficial where a simple closure try wanted.

Closure

They results from the effort and you may scratches the state transition regarding homebuyer to help you homeowner. Here’s what goes from inside the closure stage:

- You will be required to build a downpayment. You only pay a percentage of your home’s cost upfront. This new down payment proportions can vary it is usually between step three% so you’re able to 20% of your own home’s really worth.

- It requires the courtroom import away from control regarding the seller to help you your, while theoretically become the homeowner.

- You will come across a collection of data that want your trademark. These data classification the fresh new small print of your own home mortgage, the position as a debtor, and other legal aspects of the deal. Realize and you can understand per document before you sign.

Home mortgage Rates and you may Solutions

You can buy a mortgage depending on your choices regarding finance companies, borrowing unions (including Better Alliance), on the internet lenders, otherwise mortgage brokers.

Thought contrasting mortgage pricing just like the littlest improvement is also rather feeling your current costs. These types of possibilities allows you to find a very good financial together with your homeownership desires.

Conventional Mortgage

He could be supplied by an exclusive lender otherwise financial institutions that will demand a moderate 3% down payment but wanted careful adherence in order to rigorous financial obligation-to-money ratios. While they provide flexibility, fulfilling these standards is key to own qualification.

Fixed-price Financial (Predictability)

Their interest rate remains lingering regarding mortgage title of 15 in order to three decades. You will find a feeling of economic safeguards and no unexpected situations, and you may constantly know what to anticipate each month. In New jersey, the eye cost to own repaired mortgage loans try seven.31% (30-year) and you can six.74% (15-year).

Adjustable-Rate Financial (Flexibility)

Arms has actually rates which can alter considering markets standards. Right for brief-name offers in the event the initial costs try straight down however, be prepared for activity.

Government-supported Financing

They reveals gates so you’re able to homeownership of these with straight down credit ratings or quicker off repayments. Such mortgages promote more easy borrowing from the bank requirements and reduce off percentage alternatives. Several types of government-recognized financing is:

Government Casing Management (FHA Home loan): Now offers a very obtainable step three.5% down-payment and you may lenient personal debt-to-income rates perfect for very first-day people and the ones on a tight budget otherwise lower fico scores.

Pros Items Mortgages: Personal so you can pros, protected from the U.S. Agency off Pros Factors, Virtual assistant loans award military solution with positive terms, together with a different 0% down-payment chance of rural parts. However, a funding fee from the closure try 1.25% to 3.3%.

USDA Mortgages: Available for rural life style, USDA (U.S. Agencies out of Agriculture) finance offer a good 0% down-payment with no credit rating choice to offer homeownership inside the shorter inhabited elements. However they do have guaranteed fees.

Jumbo Funds

It is one of the nonconforming mortgage loans for highest-stop a house. Jumbo money financing a price surpassing the high quality constraints of your Federal Housing Loans Agencies, place from the $766,550 to own the majority of the fresh U.S. from inside the 2024. They often want a strong credit history of 680 or more and a down payment of ten% so you’re able to 15% or maybe more.

Final Terms

To order a house is very important, thus make certain you are on the right path so you’re able to buying one which have compatible mortgage loans. Simply take a step closer to your ideal home with Higher Alliance Government Borrowing from the bank Commitment. E mail us today!

Scrivi un commento