- Re-finance or reprice your own mortgage loan to get to coupons however, perform a cost-work with research very first.

- Think and make a much bigger downpayment at the start to minimize instalment amount and you will save very well total attract payable.

- Financial insurance rates comes in helpful if there is the fresh insured’s demise, terminal issues otherwise long lasting disability.

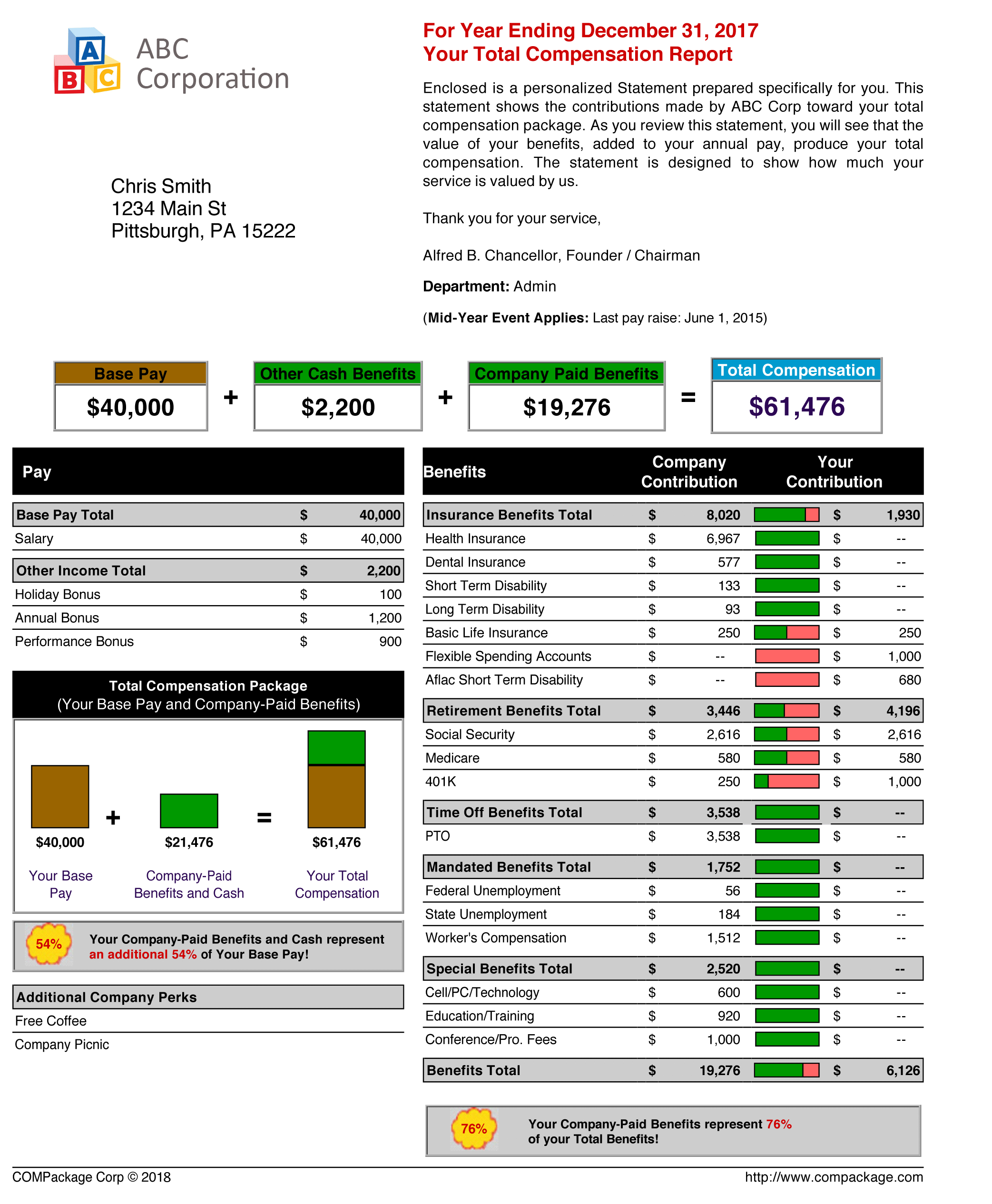

Handling your home mortgage repayments should be tough while in the an economic problem or whenever moments are difficult. Value is key to have larger-ticket orders loan places Russellville particularly property since it is probably be your own largest monthly bills.

Yet ,, remaining a roof more than the family members’ direct was an option consideration. With sensible economic considered when buying a home, there are ways to keep your mortgage repayments affordable.

That have a backup bundle will assist guarantee that owning a home is an activity you can afford actually through the difficult economic products. This can include with good hide out of disaster savings which you normally mark abreast of and you will automating a predetermined add up to an economy membership for use for mortgage. Why don’t we have a look at various ways to create your mortgage loan more affordable:

step one. And make a more impressive downpayment

While to find a home, do believe and work out a much bigger down-payment in advance because this will help to attenuate the desire will set you back payable over the borrowed funds period. you will make use of all the way down monthly obligations. Although not, create be sure to have sufficient disaster finance prior to the fresh off payment.

dos. Use your windfalls and then make partial payments

Make use of your windfalls eg yearly incentives to make limited costs on your mortgage brokers. This may decrease your outstanding principal and interest prices. Before you could accomplish that, check that you can make limited payments with no punishment.

step three. Playing with CPF finance in the place of bucks

To simply help loans their month-to-month mortgage payment, believe using your CPF finance unlike cash for those who have a rigorous earnings state. But not, before scraping in your CPF financing, carry out make sure the number in your CPF Average Membership is adequate to shell out your monthly home loan instalment as it can feel finite as well.

As soon as your financial fitness advances, imagine changing returning to playing with dollars to expend your own mortgage instalments, until their assets can also be generate ideal output compared to CPF OA at 2.5% p.good.

4. Refinance otherwise Repricing your home loan

- Refinancing – Move your HDB home loan during the dos.6% yearly to help you a mortgage that may provide a lower life expectancy interest. In addition mode you could switch you to mortgage to some other bank loan to attain offers.

- Repricing – Key your home loan package to another package on same financial. The best thing about repricing is a few banking companies bring a one-day repricing bring so you can switch to an alternative bundle to possess free. But carry out take notice not all banking institutions offer you to definitely so excite see in advance of changing.

The process will be a lot faster, to avoid smaller paperwork and can even manage to end running into fees. One example off a mortgage ‘s the DBS HDB mortgage enabling that appreciate greater coupons, protect against private accident and you may sudden death of money and extra desire obtained.

Why don’t we for example take, Andy whom has just switched their CPF home loan so you can a good DBS home loan that comes at the a fixed rates of 1.4% p.an as an excellent 5-year several months.

Remember to decide intelligently of the weigh the advantages and you will disadvantages of your home mortgage in advance of refinancing or repricing. Take time to think about if or not a predetermined or changeable speed mortgage carry out fit your goal. Make sure that you try money to lessen their rate of interest and not to boost your interest rate.

If you decided to key regarding good HDB financial so you’re able to a mortgage, it would be impossible to option to a good HDB home loan if you had people second thoughts afterwards, therefore give yourself a bit so you’re able to contemplate it.

While doing so, by taking financing regarding HDB, here won’t have any very early redemption penalties and fees. not, this new costs related to a bank loan manage include lender so you’re able to lender, therefore it is important to check if the potential notice offers are higher than the brand new switching can cost you.

Look out for prospective will cost you from the the fresh home loan also, such judge charges billed of the lender. On the flip side, some financial institutions promote cash rebates to help you offset the legal and you may valuation fees involved in refinancing.

#3 Discover a suitable mortgage bundle that suits the chance tolerance, cost and you will monetary considered requires determine your position basic instead of going for the most affordable choice right away.

Sooner, they relates to everything actually need so always remember to understand your targets. You’ll be able to generate a knowledgeable decision and you can filter choices which do not fit your.

5. Downsize to a smaller sized family

Offer and you can downgrade to a smaller household to be able to have reduced if any home loan to pay when compared with the earlier flat.

six. Renting aside rooms or perhaps the entire home

Leasing away element of your home if you have the a lot more space, will help a lot from inside the generating more income. In case it simply relates to a posture where things score tough, you can try relocating with your moms and dads and you can leasing out any family, to produce high leasing money.

7. To shop for mortgage insurance policies

Mortgage insurance policies also offers a lump sum payment of money to settle the latest outstanding home loan in the event of new insured’s demise, critical disease otherwise long lasting disability.

If you find yourself servicing home financing, you should buy one whilst protects the ones you love in the event of an emergency, such as your unanticipated death. Whenever that happens, it could end up in your household overtaking the duty out of paying the kept financial, causing a supplementary economic weight from them.

Same as how you own medical insurance to fund both you and your family facing out-of-pocket hospital expenditures, providing home loan insurance policies will cover your loved ones away from shedding the new rooftop over their brains.

8. Play with an electronic financial product

Feel financially wise and ensure you really have enough bucks to invest for your costs monthly to eliminate incurring a hill of costs.

The DBS Package & Dedicate tab when you look at the digibank is actually a good digital financial believe and you can old-age consultative device which can only help you to categorise other expenses and you will policy for your financial fitness, also accumulating a whole lot more to repay their financial, in accordance with your aims.

Begin Planning Today

Here are some DBS MyHome to work through the amounts and find property that fits your allowance and you will preferences. The good thing they cuts out of the guesswork.

As an alternative, ready yourself that have an in-Idea Acceptance (IPA), so that you has confidence about precisely how far you could potentially use to possess your residence, enabling you to know your budget correctly.

Scrivi un commento